Message

from the director, Bill Maurer

This issue of the Institute for Money, Technology and Financial Inclusion's (IMTFI) Electronic Newsletter comes out as big things are afoot in the electronic payments world. Who would have thought that the United States Post Office Inspector General would make a pitch to leverage the USPS's infrastructure to bring banking to the poor... as well as Bitcoin exchanges? Or that Bitcoin would inspire a low-cost remittance service for Kenyans? Meanwhile, the massive data breach in US Target and Neiman Marcus stores have led some American consumers to start thinking more seriously about going cash-only. This issue of the Institute for Money, Technology and Financial Inclusion's (IMTFI) Electronic Newsletter comes out as big things are afoot in the electronic payments world. Who would have thought that the United States Post Office Inspector General would make a pitch to leverage the USPS's infrastructure to bring banking to the poor... as well as Bitcoin exchanges? Or that Bitcoin would inspire a low-cost remittance service for Kenyans? Meanwhile, the massive data breach in US Target and Neiman Marcus stores have led some American consumers to start thinking more seriously about going cash-only.

What all this means for IMTFI is that our network of researchers, now over 125 strong, and in 38 countries, are finding themselves fielding a lot of questions and pursuing their projects on everyday financial practices of the poor and the use of new technologies for money savings and transfer with renewed urgency. It's been a remarkable year, with new partnerships, exhibits and convenings. We recently completed our 5th Annual Conference and have a terrific set of new working papers and other research outputs--including, as of this year, a total of 2 books authored by our researchers, 25 published academic and policy papers, and 72 presentations to audiences in academia, policy, and industry.

We have been distilling lessons learned from our ever-growing portfolio of original case studies of mobile money in the lives of the poor. We released a new, synthetic report, Warning Signs and Ways Forward, on what we have learned about what drives people to use a mobile money service and what prevents them from doing so. We've also been paying close attention to the explosion of new services, business models and regulatory discussions that are accompanying heightened interest in digital payments.

With our impressive and growing global footprint, including not only our researchers, who often live and work where they conduct their investigations, but also our connections with academic, nonprofit, policy, industry, design and regulatory networks, IMTFI is continuing to shape the conversation about the potential of mobile and digital money in the developing world and beyond.

To read the earlier issues of the IMTFI newsletter, see here.

Bill Maurer, Director

FEATURED NEWS

Showcase Warning Signs and Ways Forward

Our recent publication "Warning Signs and Ways Forward" identifies recurring themes and insights that have emerged through the course of the first four years of research by IMTFI fellows.

We highlight some cross-cutting issues affecting client uptake for mobile and other electronic payment platforms. Some of the insights discuss opportunities for developing new services or laying new products on existing platforms. Others are warning signs: institutions, norms, and practices that have impeded uptake, in multiple contexts.

We invite you to view the full booklet, accompanied by photos from a sampling of IMTFI projects: Warning Signs and Ways Forward: Digital Client Uptake Document, November 2013.

IMTFI's 5th Annual Conference

December 2013 marked IMTFI's fifth annual conference. IMTFI fellows and funded researchers came together at the University of California, Irvine to present their work-in-progress and to think through new collaborations.

December 2013 marked IMTFI's fifth annual conference. IMTFI fellows and funded researchers came together at the University of California, Irvine to present their work-in-progress and to think through new collaborations.

The conference featured projects from 15 countries on topics ranging from the workings of Islamic finance in Bangladesh, to gambling with mobile money in Uganda; from the infrastructure of hawala transfers among the east African Somali diaspora,  to histories of class and caste embedded in the semiotics of gold among South Indian silk workers. to histories of class and caste embedded in the semiotics of gold among South Indian silk workers.

To learn more about the conference proceedings and the discussions that followed watch videos of panels and read the detailed live-blog from Liz Losh. For photos see IMTFI Flickr stream.

WORKING PAPERS AND RESEARCH

Patterns of Financial Behavior among Rural and Urban Clients: Some Evidence

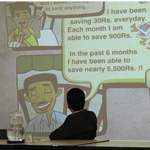

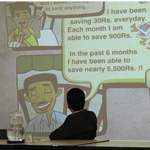

Patterns of Financial Behavior among Rural and Urban Clients: Some Evidence from Tamil Nadu, India by IMTFI researchers Lakshmi Kumar and Jyoti Prasad Mukhopadhay identifies some key differences in the financial behavior of the rural and urban poor in the state of Tamil Nadu, India. The study used financial diaries to collect data on income, consumption, savings, loans, and insurance from a sample of poor households over a period of six months. Click here to read executive summary.

Patterns of Financial Behavior among Rural and Urban Clients: Some Evidence from Tamil Nadu, India by IMTFI researchers Lakshmi Kumar and Jyoti Prasad Mukhopadhay identifies some key differences in the financial behavior of the rural and urban poor in the state of Tamil Nadu, India. The study used financial diaries to collect data on income, consumption, savings, loans, and insurance from a sample of poor households over a period of six months. Click here to read executive summary.

What Drives Behavioral Intention of Mobile Money Adoption? The Case of Ancient Susu Saving Operations in Ghana

What Drives Behavioral Intention of Mobile Money Adoption? The Case of Ancient Susu Saving Operations in Ghana by IMTFI researcher Eric Osei-Assibey looks into the ancient susu savings operation in Ghana and the behavioral intention or willingness of susu collectors and users to adopt a mobile money (MM) platform as part of their savings practices. The study investigates various technological and human factors that determine one's intention to adopt the MM space as a savings channel, particularly in place of more traditional ways of saving among many people in West Africa.

What Drives Behavioral Intention of Mobile Money Adoption? The Case of Ancient Susu Saving Operations in Ghana by IMTFI researcher Eric Osei-Assibey looks into the ancient susu savings operation in Ghana and the behavioral intention or willingness of susu collectors and users to adopt a mobile money (MM) platform as part of their savings practices. The study investigates various technological and human factors that determine one's intention to adopt the MM space as a savings channel, particularly in place of more traditional ways of saving among many people in West Africa.

DESIGNS FOR BETTER FINANCIAL SERVICES

Betting on Chance in Colombia: How Game Network Operators Succeed in Providing Financial Services to the Poor While Other Networks Fall Behind

Betting on Chance in Colombia: How Game Network Operators Succeed in Providing Financial Services to the Poor While Other Networks Fall Behind by IMTFI researchers Ana Maria Echeverry and Coppelia Herran is a design proposal that seeks new ideas and answers to achieve financial inclusion by working with and adapting services originally intended for gambling. In Medellin, Colombia, Echeverry and Herran found that people living below the poverty line were using game network operators as a means of conducting their daily financial activities. Read the report in English and Spanish.

Betting on Chance in Colombia: How Game Network Operators Succeed in Providing Financial Services to the Poor While Other Networks Fall Behind by IMTFI researchers Ana Maria Echeverry and Coppelia Herran is a design proposal that seeks new ideas and answers to achieve financial inclusion by working with and adapting services originally intended for gambling. In Medellin, Colombia, Echeverry and Herran found that people living below the poverty line were using game network operators as a means of conducting their daily financial activities. Read the report in English and Spanish.

Journeys for Water, by Gaurav Bhushan, Nitin Gupta, & Jennifer Lee Fuqua

A multi-disciplinary frog team with funding from IMTFI explored how consumers in India acquire, store and use drinking water. The team traveled from Ahmedabad to Delhi to examine the roll-out of a new water delivery service from Sarvajal, a company that supplies paid-for drinking water in rural areas and looking to expand into urban slums through a novel "water ATM." The study explored how consumers perceive the value of water in both real and abstract terms, with a view to impacting the design and rollout of Sarvajal's water ATM.

A multi-disciplinary frog team with funding from IMTFI explored how consumers in India acquire, store and use drinking water. The team traveled from Ahmedabad to Delhi to examine the roll-out of a new water delivery service from Sarvajal, a company that supplies paid-for drinking water in rural areas and looking to expand into urban slums through a novel "water ATM." The study explored how consumers perceive the value of water in both real and abstract terms, with a view to impacting the design and rollout of Sarvajal's water ATM.

Landscaping Mobile Social Media and Payments in Indonesia

Two teams of researchers led by anthropologist Tom Boellstorff and supported by sicap and IMTFI recently concluded a study of the "triple intersection" of (1) smartphones; (2) social network sites; and (3) purchasing and selling online in Indonesia, the fourth most populous nation and home to more Muslims than any other country. The research teams focused on the cities of Surabaya (East Java province) and Makassar (South Sulawesi province) looking into how mobile devices are being used for buying and selling when combined with social network sites like Facebook. Read more about this project's activities and key findings here.

Two teams of researchers led by anthropologist Tom Boellstorff and supported by sicap and IMTFI recently concluded a study of the "triple intersection" of (1) smartphones; (2) social network sites; and (3) purchasing and selling online in Indonesia, the fourth most populous nation and home to more Muslims than any other country. The research teams focused on the cities of Surabaya (East Java province) and Makassar (South Sulawesi province) looking into how mobile devices are being used for buying and selling when combined with social network sites like Facebook. Read more about this project's activities and key findings here.

COLLABORATIVE PROJECTS AND PUBLIC ENGAGEMENTS

IMTFI money artifacts on display at USC's Trillion$: The Awesome Power of the Federal Reserve

Select artifacts and resources from IMTFI's collection of money objects and paraphernalia were part of Trillion$: The Awesome Power of the Federal Reserve, an exhibit commemorating the centennial of the United States Federal Reserve presented by the USC Libraries and the Federal Reserve.

Select artifacts and resources from IMTFI's collection of money objects and paraphernalia were part of Trillion$: The Awesome Power of the Federal Reserve, an exhibit commemorating the centennial of the United States Federal Reserve presented by the USC Libraries and the Federal Reserve.

Exhibit -"Figuring Exchange: Art and Money"

IMTFI and the Claire Trevor School of the Arts had the pleasure of hosting artist Máximo González whose art created from devalued currencies sparks conversation on money, banking and finance. González's money pieces include figurative murals of debauched historical figures and fantastic machines that ravage landscapes; abstract weavings and collages that deconstruct money's figurative powers; and performance pieces that enact the ambiguities of value and exchange. To learn more about the exhibit and about González art, read commentary by curator Robert Kett.

IMTFI and the Claire Trevor School of the Arts had the pleasure of hosting artist Máximo González whose art created from devalued currencies sparks conversation on money, banking and finance. González's money pieces include figurative murals of debauched historical figures and fantastic machines that ravage landscapes; abstract weavings and collages that deconstruct money's figurative powers; and performance pieces that enact the ambiguities of value and exchange. To learn more about the exhibit and about González art, read commentary by curator Robert Kett.

IMTFI-supported research and guest contributions on the IMTFI blog

Our blog has continued to provide fresh updates, reports, and think-pieces from the field. Recent highlights from IMTFI fellows include: Eduardo Henrique Diniz and Adrian Kemmer Cernev's notes on the enfolding of a mobile payment pilot project in Brazil; Erin Taylor's reflections on mobilizing mobile money in post-earthquake Haiti; Magdalena Villarreal and Isabelle Guérin's comparison of the uses of gold in Mexican and Indian villages; Ishita Ghosh and Kartikeya Bajpai's observations on the uses of and expectations from EKO-SBI remittance vs savings products in India; and Tonny Omwansa's findings on the impact of pure mobile micro-financing on the poor in Kenya.

Videos

Check out recent videos featuring interviews and commentaries from our researchers.

IMTFI fellow Dr. Sibel Kusimba talks about her research on mobile money and social networks in Kenya in an interview at the American Anthropological Association's 2013 Annual Conference in Chicago.

"Mobile Social Currency: Community Development Banks Point of View" by Eduardo Henrique Diniz and Adrian Kemmer Cernev on YouTube.

IMTFI graduate research assistant Taylor Nelms comments on the recent developments around the Bitcoin bubble in an interview with First Business.

COMING SOON

Be sure to check back regularly, as announcements of the latest cohort of IMTFI-funded research projects will be released soon!

|

This issue of the Institute for Money, Technology and Financial Inclusion's (IMTFI) Electronic Newsletter comes out as big things are afoot in the electronic payments world. Who would have thought that the United States Post Office Inspector General would make a pitch to leverage the USPS's infrastructure to

This issue of the Institute for Money, Technology and Financial Inclusion's (IMTFI) Electronic Newsletter comes out as big things are afoot in the electronic payments world. Who would have thought that the United States Post Office Inspector General would make a pitch to leverage the USPS's infrastructure to

December 2013 marked IMTFI's fifth annual conference. IMTFI fellows and funded researchers came together at the University of California, Irvine to present their work-in-progress and to think through new collaborations.

December 2013 marked IMTFI's fifth annual conference. IMTFI fellows and funded researchers came together at the University of California, Irvine to present their work-in-progress and to think through new collaborations.  to histories of class and caste embedded in the semiotics of gold among South Indian silk workers.

to histories of class and caste embedded in the semiotics of gold among South Indian silk workers.

Betting on Chance in Colombia: How Game Network Operators Succeed in Providing Financial Services to the Poor While Other Networks Fall Behind by IMTFI researchers Ana Maria Echeverry and Coppelia Herran is a design proposal that seeks new ideas and answers to achieve financial inclusion by working with and adapting services originally intended for gambling. In Medellin, Colombia, Echeverry and Herran found that people living below the poverty line were using game network operators as a means of conducting their daily financial activities. Read the report in

Betting on Chance in Colombia: How Game Network Operators Succeed in Providing Financial Services to the Poor While Other Networks Fall Behind by IMTFI researchers Ana Maria Echeverry and Coppelia Herran is a design proposal that seeks new ideas and answers to achieve financial inclusion by working with and adapting services originally intended for gambling. In Medellin, Colombia, Echeverry and Herran found that people living below the poverty line were using game network operators as a means of conducting their daily financial activities. Read the report in  A multi-disciplinary

A multi-disciplinary  Two teams of researchers led by anthropologist Tom Boellstorff and supported by

Two teams of researchers led by anthropologist Tom Boellstorff and supported by  Select artifacts and resources from IMTFI's collection of money objects and paraphernalia were part of

Select artifacts and resources from IMTFI's collection of money objects and paraphernalia were part of  IMTFI and the Claire Trevor School of the Arts had the pleasure of hosting artist

IMTFI and the Claire Trevor School of the Arts had the pleasure of hosting artist